Cool Info About How To Write Off Bad Debt

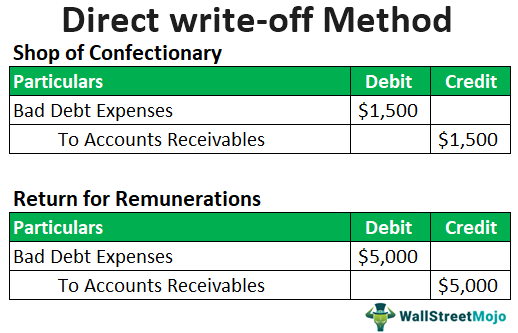

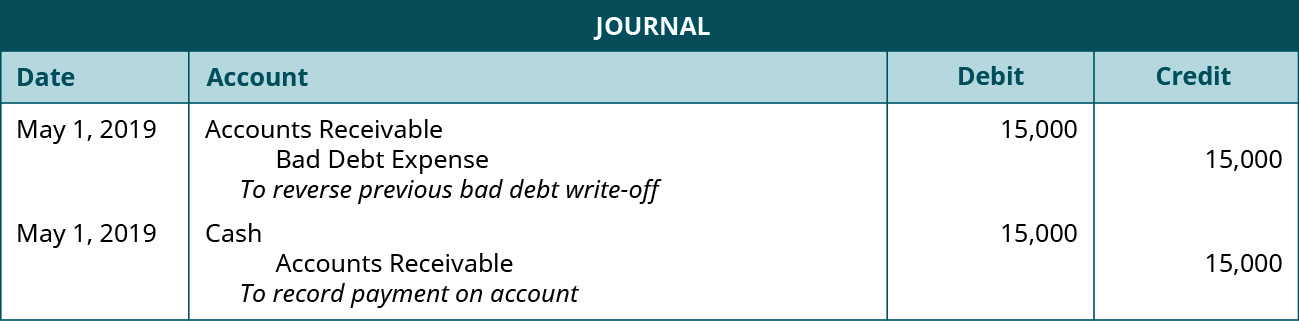

In essence, there are two approaches to writing off bad debts.

How to write off bad debt. Bad debt write off bookkeeping. Learn how to write off a bad debt in quickbooks with rhonda rosand, cpa, advanced certified quickbooks proadvisor of new business directions, llc.new busines. This account holds all of the account information for any bad debts that a business may be facing.

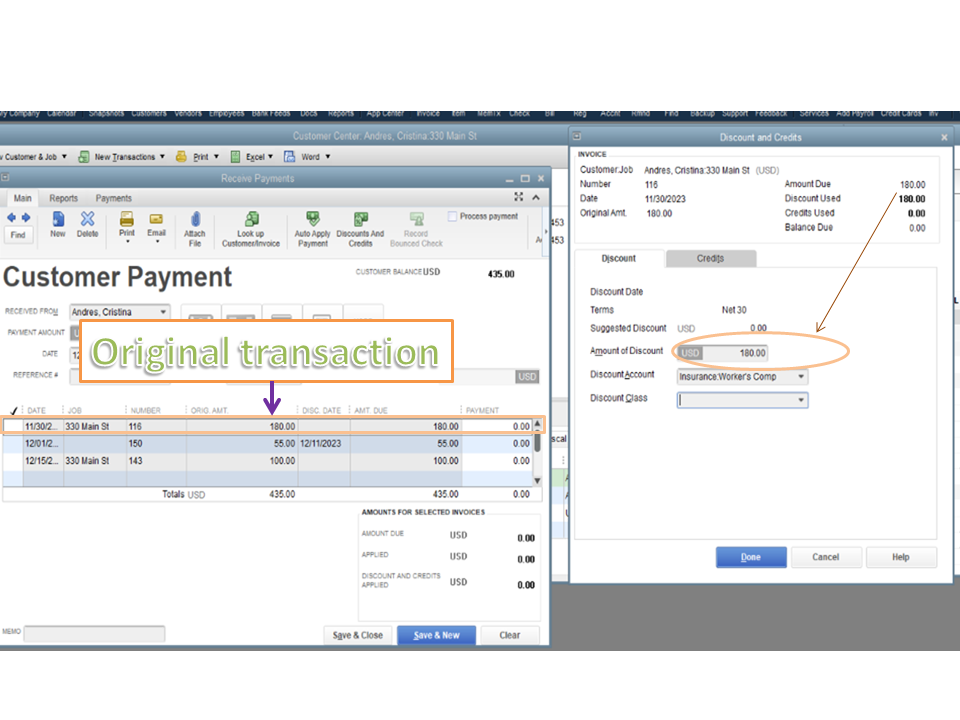

In the product/service section, select bad debts. ‘bad debts’ in the product/service section; Select the account menu and then new.

Change the selector to payment type. In the message displayed on statement box, enter “bad debt.” select save. Click on add to enter the following to create the new entry:

Enter ‘bad debt’ in the ‘message displayed’ box; Identify the customer and invoice number to be written off as a bad debt. Determine the method you will use to write off bad debts.

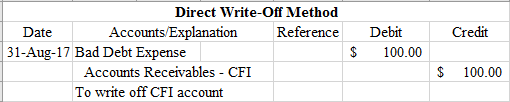

Journal entry for the bad debt write off the accounting records will show the following bookkeeping entries for the bad debt written off. In the amount column, enter the amount you want to write off. Use the bad debt item and description in the credit memo to write off the debt.

Both processes differ from each other and how. Go to the lists menu and select chart of accounts. Enter an account name, for example, bad debt.