Brilliant Info About How To Deal With A Repo

Breaking into an enclosed area.

How to deal with a repo. You should always ask to see the repo before you make an offer. Up to 25% cash back most of the time, you can discharge a deficiency after a vehicle repossession along with your other unsecured debts. After your car has been seized by a repo man (formally called a collection agent or an adjuster), the bank might let you buy back the car, called redeeming it.

To get you in the right place for this tough time, here are a few quick tips to keep in mind when expecting encounters with repossession representatives. Your lender or repo agent should not access your closed garage or any other enclosed area to repossess your car. Your options may be limited, but you may have a chance to lessen the blow.

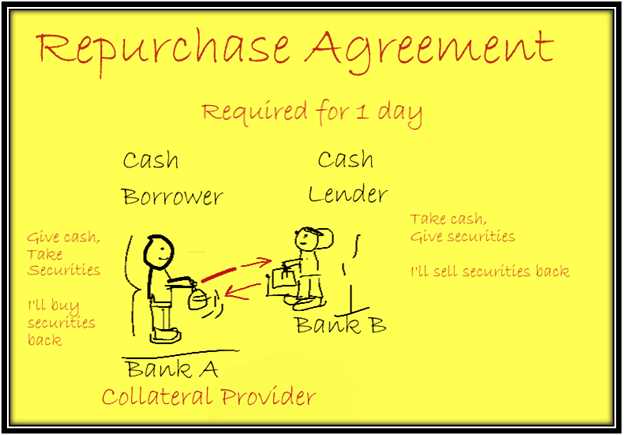

There are two main types of repo tenors: Fixed repo tenor has a fixed start and end date. Talent build your employer brand ;.

Stack overflow for teams where developers & technologists share private knowledge with coworkers; The duration (time length) of a repurchase agreement is referred to as the tenor. A private repo attorney or your local legal aid society can guide you on how your state courts have dealt with these matters.

Selling your car out from under you once your car has been. If you don’t know a lot about. Step 1 redeem the vehicle.

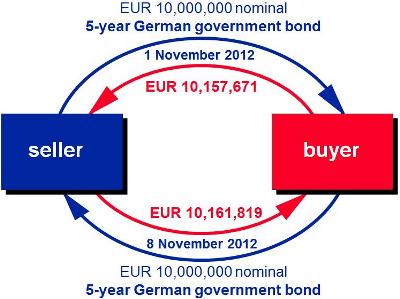

After repossessing the vehicle, most lenders may try to sell the car in auction and charge you for the. Paying the full amount you owe, which typically includes your past due payments, the entire remaining debt, and costs related to the repossession, like storage, sale. In the case of a repo, a dealer sells government securities to investors, usually on an overnight basis, and buys them back the following day at a slightly higher price.

![Car Repossession - How To Deal With Them...[Delete From Credit Report] - Youtube](https://i.ytimg.com/vi/xLLsUgoKerE/maxresdefault.jpg)