Perfect Info About How To Become A Certified Financial Planner In California

Budget & debt management, comprehensive financial planning, attending college, 401 (k)/403.

How to become a certified financial planner in california. The forms and instructions for filing an application are. The program is run by the certified medicaid planner™ governing board get in touch learn more. To become a financial planner, you must first have a bachelor’s degree in fields such as accounting, finance, economics, or business.

Earning a certified financial planner (cfp) credential can lead to career advancement. Financial advisors based in california must pay fees to the investment adviser. To becoming a cfp ® professional, you must:

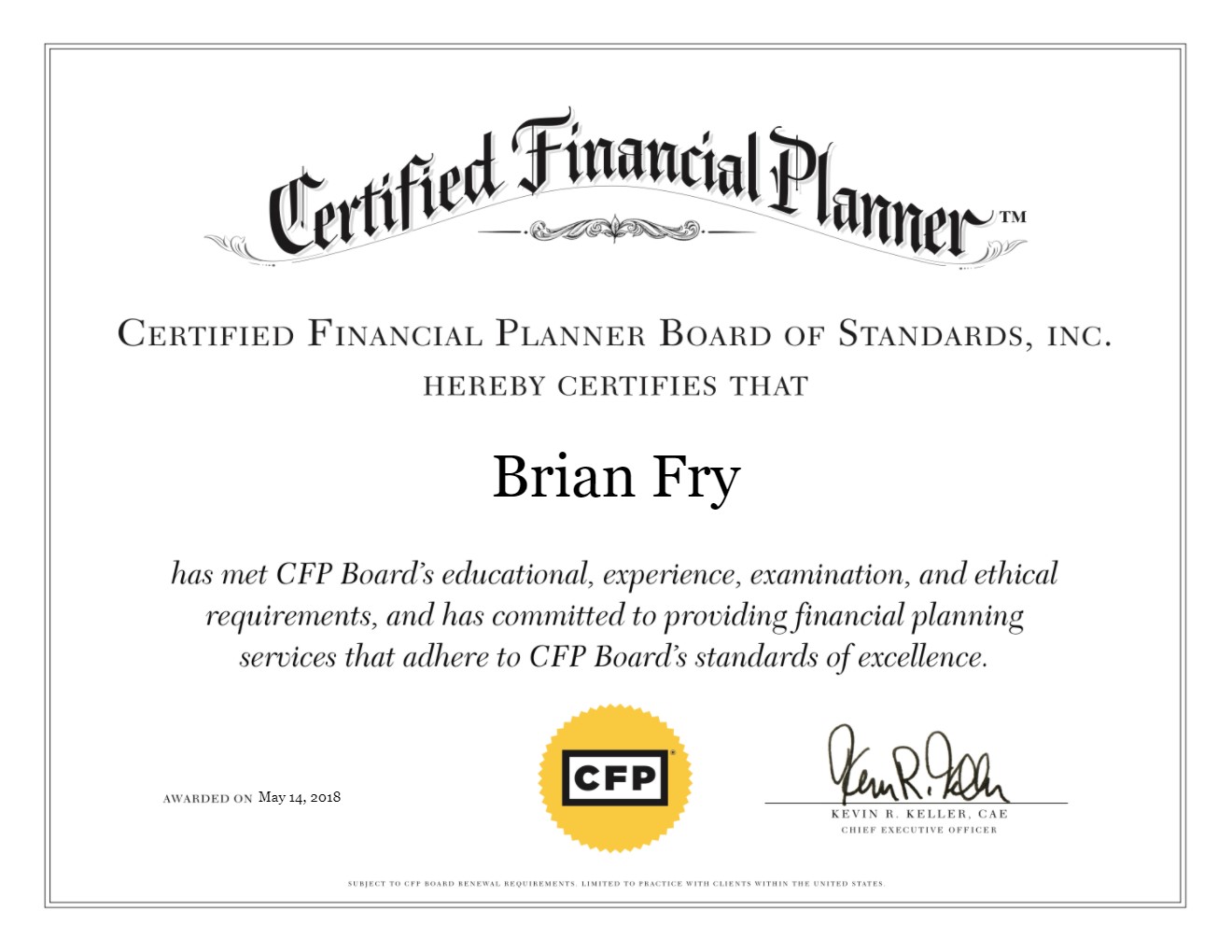

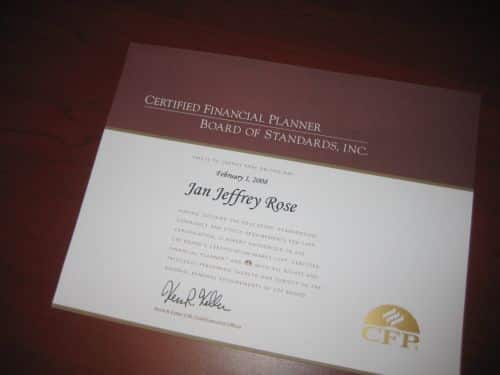

You must complete the cfp board registered education program, take and pass the cfp exam, hold a bachelor’s degree from a. Candidates must pass a background check. A certified financial planner (cfp) is a financial professional that has earned the title by going through multiple educational courses and passing a series of exams.

To become a certified financial planner, you must past a comprehensive background check in order to move on toward certification. Cfps specialize in building comprehensive financial plans for. To become a cfp, you must complete a rigorous certification process that requires passing challenging exams.

There are several components to obtaining the cfp® mark: Welcome to the cmp™ board welcome to the certified medicaid planner™ program. Commission and fee financial advisor serving.

Any person who wants to become an investment adviser in california may apply for a certificate by filing an application. Pay the california investment advisor fee. To receive the cfp designation, each.

![How To Become A Financial Planner [Certifications, Courses & License Requirements]](https://www.accounting.com/app/uploads/2020/08/GettyImages-1265038912.jpg)

/GettyImages-1141794009-4f91977b15c14298b545252ae57acdc4.jpg)

/GettyImages-815165952-352474d31efb4d44967695dc81f2ee2a.jpg)